We all know there’s gold in the rocks around here. But there aren’t any large-scale gold projects. The McLaughlin Mine near Lake Berryessa straddled three counties in California (Lake, Yolo, and Napa) and produced 17 million ounces of gold from 1985-2002. It’s a reclamation project now.

There’s a big mine in Southern California—Mesquite—that produces gold. And there is still plenty of gold in the Mother Lode. An Australian company expects the famous Lincoln Mine to start producing again.

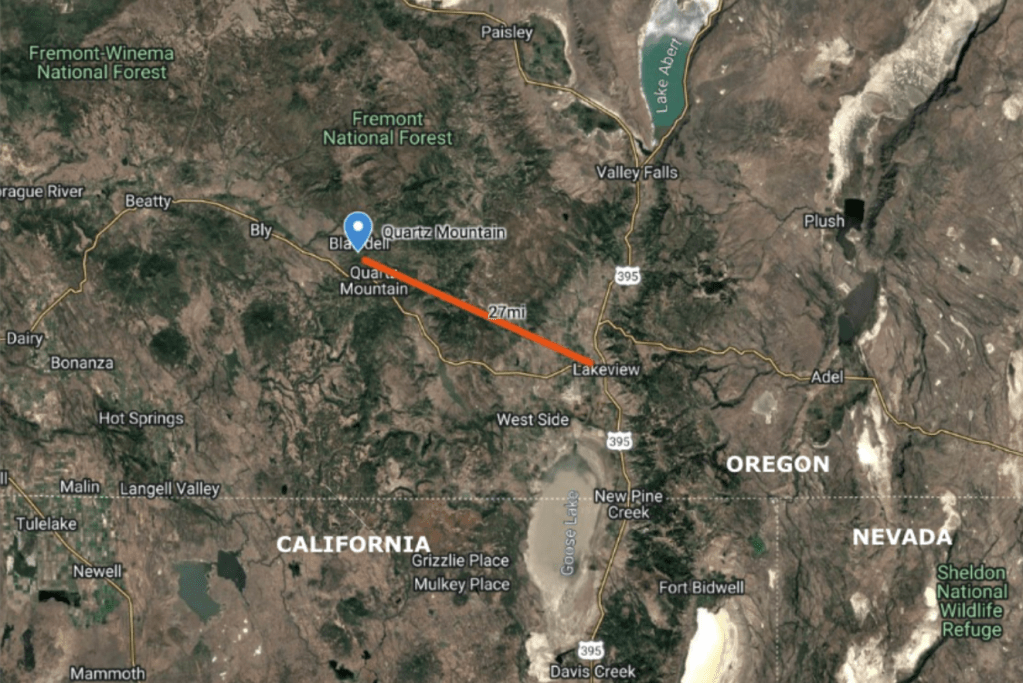

Mesquite and McLaughlin are open pit mines. The Lincoln is underground. Most miners would prefer an open pit, with the resource close to the surface. But sometimes you have to dig. There’s a spot in Oregon that they are drilling again these days. It is called Quartz Mountain.

That’s about a three-hour drive from here.

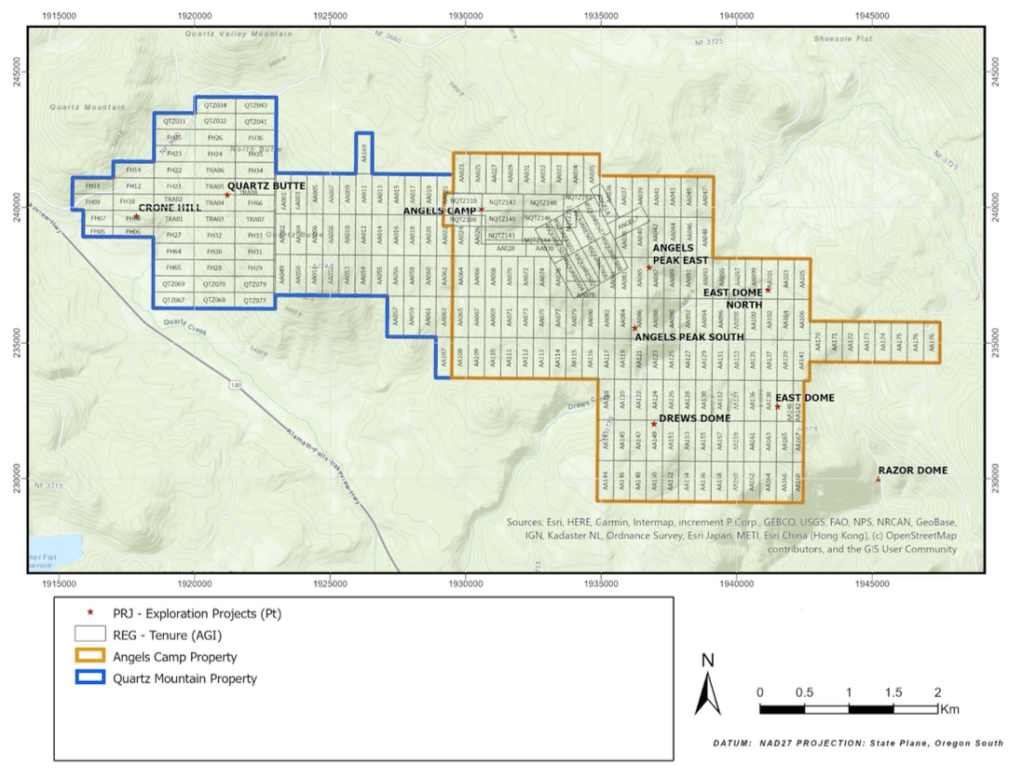

The company (Q-Gold) is based in Toronto and they have a bunch of claims and an ambitious drilling program.

Lots of things are converging to make gold mining popular again. The price, currently over three thousand dollars per troy ounce, is very attractive! Second, gold demand always goes up in times of economic uncertainty. With the Great Orange Loon Job & His Criminal Cabal in charge most folks think that their finances are on shakier ground than they were before. Finally, there is increasing industrial use for gold and thus it has taken on the status of a strategic material.

Plus people are just wacky for gold.

By gold mining standards Q-Gold is a pretty podunk outfit. They have a market cap of $12M and a share price (on the Canadian exchange) of ten cents. For comparison, Colorado-based Newmont Corporation has a market cap of $65B and a share price (on the NYSE) of fifty-eight bucks. Newmont is the biggest gold miner in the world.

But the world is full of so-called “junior” miners and Canada is a real hotbed of mining investment. They depend on their mining sector for a big chunk of their economy.

So perhaps we’ll see a new Gold Rush here in the West. It won’t look like the 1850s, that’s for sure. But it could happen “just around the corner” from where I live. I think I might throw a few bucks their way. One thousand shares of Q-Gold will cost me about a hundred bucks.

I think I can spare it. Maybe I’ll get rich!

Or maybe this outfit will fold in a few years and the property will get absorbed by some other outfit and some other schmuck will be throwing a few bucks at them for a few shares twenty years from now. Maybe they’ll get rich!