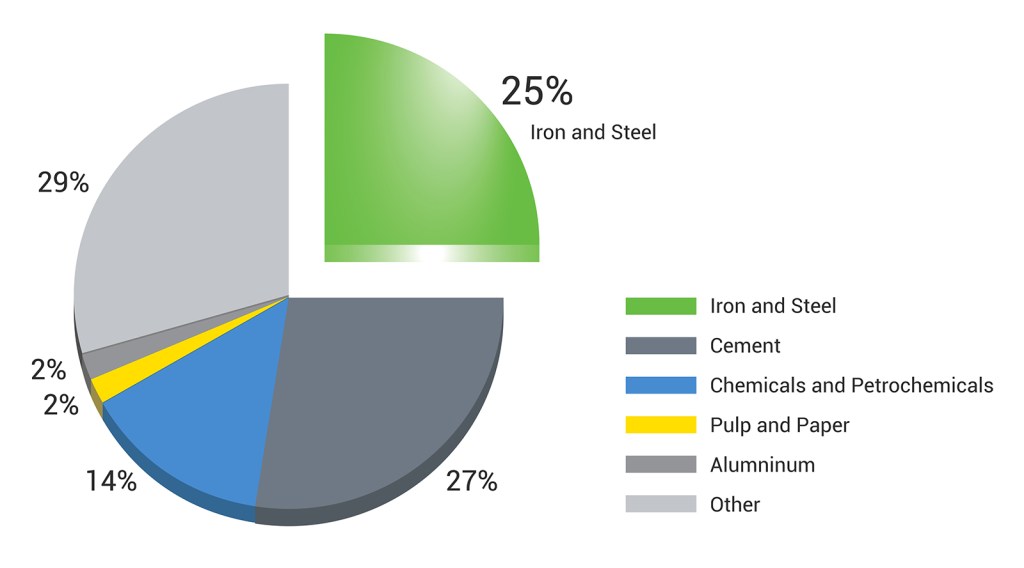

Vaclav Smil likes to look at what he calls “the four pillars of civilization“: cement, steel, plastics, and ammonia.

Cement is the key ingredient of concrete. The other two ingredients are aggregate (sand, gravel, etc.) and water. We often use the words “cement” and “concrete” interchangeably but one precedes the other. Cement is the fine, gray powdery stuff we buy in 90-lb. sacks. Concrete is what happens when we mix cement with the aggregate and water, form it into place, and allow it to cure and thus harden. In fact what we call “cement trucks” are really “concrete mixer trucks.”

But the distinction, at least for the purposes of this discussion, are not so important. Cement is useless by itself. It is important because it is the key constituent of the most important of all building materials—concrete. Global cement production is an enormous industry, on the order of four billion metric tons per year. A metric ton (or “tonne”) is 1000 kilograms or about 2200 pounds. My 2019 Honda CR-V checks in at 3400 pounds or about 1.5 metric tons, so the world manufactures approximately 2.7 BILLION Honda CR-Vs worth of cement!

The next most important building material is steel. I suppose it is silly to rank concrete above steel, and I don’t mean to imply that one is “above” the other. In fact the two go hand-in-hand. Most concrete is steel-reinforced. Concrete has wonderful compressive strength. It doesn’t crush easily and that’s why it makes good foundations. But it lacks torsional strength. If it is subject to twisting forces it cracks and crumbles and falls apart. Next time you see a construction site look carefully at the various metal rods sticking out of the concrete forms. Freeway overpasses are a good place to see this. Without the reinforcing materials concrete would have very limited applications.

But steels are used as building materials in their own right, of course, and are the preferred substance for car and plane bodies, household goods, tools of all sizes, and so on. The stuff is so ubiquitous it is hardly worth listing the various uses. Just take a look around and you will see some kind of steel wherever you are.

World steel production is about two billion metric tons per year. Steel is an alloy. Its primary constituent is iron. Iron ore is mined globally. Almost all of it goes into steelmaking. Fortunately steel can be recycled and with modern electric arc furnaces less steel needs to be made directly from ore. Iron is found in nature as an oxide and it takes a lot of energy to separate the large mass of oxygen atoms from the iron atoms. The other chemicals used in steel are carbon and manganese which usually account for less than 2% of the alloy. Stainless steels rely on chromium and can contain up to 10% of that metal. Steels have been used, like concretes and mortars, since antiquity.

Nothing so symbolizes the modern world better than plastics. The word means “malleable” but is applied particularly to the hydrocarbon-based stuff we see all around us. It is the replacement of ancient materials (wood, wool, leather, metals, etc.) by plastics that mark our times. World production of plastics is just under 400 million metric tons per year and growing. Most plastics are used in packaging but there are so many other uses mostly because there are a huge variety of plastic types. We are familiar with many of them, from PET (soda bottles) to nylon (rain gear) to polycarbonate (eyeglass lenses) to ABS (keyboards) to PVC (pipes) to polystyrene (yogurt containers).

The feedstock for plastic production is mostly natural gas but crude oil and naphtha are also important. In fact the types of plastics and their production methods are so varied that it is impossible to estimate how much of our hydrocarbon resources are devoted to making plastics. It’s estimated that all the humans on earth weigh a combined 300 million tonnes so that gives you some idea of the scale of plastic production!

The fourth and final pillar of our civilization is ammonia. I’m not talking about the stinky stuff people mop floors with. That’s “household ammonia” or a dilute solution of ammonium hydroxide. Ammonia is gas. Household ammonia is made by bubbling this gas through water.

Ammonia (NH3) is produced from air (the source of the nitrogen) and natural gas (the source of the hydrogen). It’s a very energy-intensive endeavor. Over 200 million metric tons are produced per year. If you want to measure the degree of wealth and industrial development of a country look at their ammonia production. Another indicator would be sulfuric acid. One could argue that sulfuric acid ought to be included as a “pillar” of the modern world.

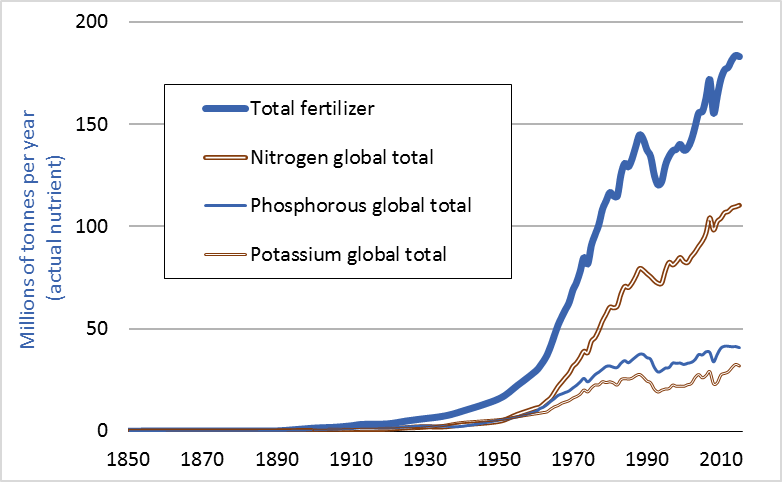

Ammonia is needed to make fertilizer. Without fertilizer most of us would starve to death. Or, at least, we’d spend our days much like our ancient forbears, laboring in the field from sunup to sunset producing our food. We have more people than ever in history and yet we produce far more food, especially per acre, and a smaller and smaller percentage of our population is directly involved in food production. In olden days everyone was a farmer. Now hardly anyone (in a modern country) is a farmer. This is because of synthetic fertilizers primarily produced from ammonia. Not to mention tractors, herbicides and insecticides, crop breeding, and the rest! The “organic” farmer uses fertilizers, too, just ones made from compost, manure, guano, blood meal, bonemeal, fish emulsion, kelp and the like. Without fertilizer there would be no large-scale food production, organic or otherwise.

Regardless of your personal philosophy, ideology, or political leanings, there are some basic facts about the world that are not arguable. We would do well to study such things. The facts about these physical and biological constraints ought to unify us. We all have to breathe, drink, eat, and be sheltered from the elements. A close look at energetics and ecological principles makes it clear that our political solutions are based on many false assumptions. Let’s strip away the crap and focus on the real problems at hand. A good place to start is with Smil’s “four pillars.” You may disagree with his priorities but you can’t argue with his numbers. In other words, maybe you think we shouldn’t make so much steel and concrete and we should devote that energy to other things. OK, that’s fair. Get your pencil-and-paper out and sketch an alternative!

Just don’t neglect the basic science and math. If you don’t put numbers on your notions, you’re just adding to the babble. I can’t measure the babble but there’s certainly too much of it.